Connected Car Insurance

The Challenge

Ertuğrul Sezik explains why AXA Sigorta started developing AXA GO: “We wanted to create the telematics platform AXA GO to connect more frequently with our customers while stimulating safe driving behavior. We care about our policy holders: if they are safe drivers, they reap the benefits of a personalized car insurance policy. In this way we hope to stimulate safe driving. The only way to achieve this is to get insight into the individual driving behavior. That’s why we have developed AXA GO.” AXA Sigorta set up a pilot, which is now used by a thousand policy holders.

The Goal

The goal of the project is to reduce accidents and to help people improve their driving through offering drivers insights in their driving behavior. Safe driving is measured by factors such as speeding, accelerating, harsh breaking, and phone usage – including handsfree usage. “Surveys show that when people drive while calling handsfree, their concentration is affected. There’s a direct relation between car accidents and (handsfree) calling behind the wheel.” The pilot was offered to policy holders in the ages of 18 to 25. “This focus group tends to be more tech savvy. Also, younger drivers are seen as more risky drivers because they don’t have much experience on the road. They do like a challenge though; that’s why we offer benefits if they can prove they drive safely.”

How it Works

In order to make AXA GO a success, every step in the customer journey of AXA GO policy holders had to be automated.

Ertuğrul Sezik: “For example, in the onboarding stage, the policy holder firstly verifies their personal information. After this identification, they give consent for gathering personal information about the driving.

They will receive a device to place in their car and will receive updates about the delivery and installation. In the entire customer journey, we provide information and instructions for every step. For instance, after identifying the policy holder we send them a SMS, using the number provided, to inform them what the next step is. And when the device is shipped, another SMS states ‘your shipment is on the way’. After delivery, we send a message on how to install the device in the car, how to download AXA GO, and how to use the app. The Be Informed platform is the strategic component to personalize these customer journeys, all fully automated.”

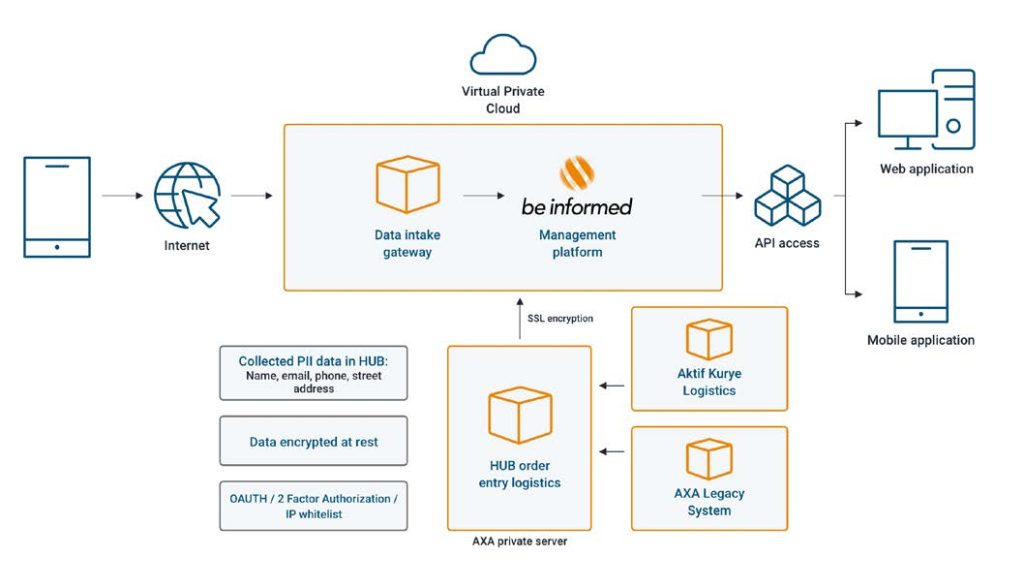

To make all this happen, AXA’s systems had to be connected and communicate with one another.

“Therefore, we needed orchestration and integration with for example AXA’s core insurance system, SMS system, and mail exchange system. We integrated the courier company system to digitally trigger orders

and inform them about the delivery. An American platform monitors the devices and had to be incorporated as well. We found that Be Informed was the best platform to achieve this with. Together with Be Informed, we set up more than twenty integration points. During the customer journey, there are a lot of automated decisions that have to be made. Be Informed was all we needed to handle these challenges surrounding orchestration, integration, and personal customer journeys.”

Collaboration with Be Informed

Compared to traditional development methods, AXA GO was developed significantly faster with Be Informed.

Ertuğrul Sezik: “With Be Informed it was possible to achieve easy integration with all of our systems. Furthermore, it took us three months to implement AXA GO with the Be Informed team, including design and analyses. That’s 7 months faster than with our own IT department. The reason we worked with Be Informed: they design and implement fast, facilitate the customer journey, and are able to develop with a low dependence on our IT. Be Informed is a low code platform, in which we use modeling instead of programming to create a solution. We experienced a lot of advantages, such as the automated creation of documentation in our own language. It’s accessible, readable and understandable for anyone who gets to work with it, not just the people familiar with the Be Informed platform.”

“Be Informed is really cooperative. We had many last-minute requests they took care of very swiftly, understanding our urge and need. Also, they are thoroughly informed and insightful. They loved our initiative and were good at anticipating on the concept. They came up with ideas, which is important.”

Future of AXA GO

“We will definitely go further with AXA GO and Be Informed; it’s a big multi-year project. The introduction of AXA GO so far was just the tip of the iceberg.”

After a second pilot with approximately 2000 users, AXA GO will potentially be used by 20.000 policy holders in Turkey.